- Dec 19, 2025

- By My Store

- 0 comments

The Economics of the U.S. Vape Industry: Margins, Pricing & Retail Strategy (2025)

The Economics of the U.S. Vape Industry: Margins, Pricing & Retail Strategy in 2025

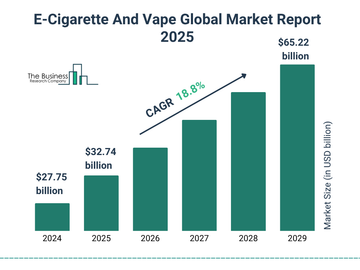

The financial structure of the U.S. vape industry continues to evolve as regulations shift and consumer expectations rise. For wholesalers and retailers, 2025 introduces new pricing strategies, margin opportunities, and inventory management challenges. Understanding the economics behind the category is essential for building a profitable vape business.

1. Disposable Vapes Remain the Revenue Engine

Disposables lead the market in turnover and profit. Retailers benefit from high volume, strong consumer demand, and predictable repurchase cycles. High-capacity models allow for premium pricing while maintaining competitive margins.

Key profit drivers:

- High velocity of consumer purchases

- Premium pricing on 15k–25k puff models

- Low operational cost for retailers

2. Pod Systems Offer Recurring Revenue

While disposables generate high turnover, pod systems generate recurring revenue from replacement pods and coils. This creates stability in monthly revenue streams for retailers.

Smart retailers maintain balanced shelf space between disposables and refillables for maximum profit.

3. Inventory Strategy: The New Priority in 2025

With FDA enforcement shaping product availability, retailers must:

- Monitor compliance updates weekly

- Avoid overstocking high-risk SKUs

- Stock compliant alternatives for rapid substitution

Inventory flexibility is essential for uninterrupted sales.

4. Regional Pricing Differences Across the U.S.

The U.S. vape market varies significantly by state. States with stronger restrictions often have higher retail pricing due to limited availability, whereas open states benefit from competitive pricing.

Pricing influencers:

- Flavor restrictions

- Wholesale supply availability

- Consumer income levels

- Retail competition density

5. The Future of Vape Economics

As PMTA decisions solidify and manufacturers adapt to new compliance standards, the market will shift toward fewer but more trusted brands. Retailers who form long-term partnerships with compliant wholesalers will benefit from stable supply and stronger margins.

The key to success in 2025: diversify, stay compliant, and remain flexible.